JLL (NYSE: JLL) Thailand, a global real estate consultant has successfully facilitated a major real estate transaction, securing a prime land along Bangna-Trat Road for one of the world’s largest digital infrastructure companies. JLL’s global connectivity, comprehensive database, and insightful market knowledge enabled a seamless transaction process, ensuring optimal outcomes for all parties involved.

The transaction on Bangkok’s Bangna-Trat Road further reinforces the strategies of many data centre operators to invest in Thailand is based on the country’s readiness to serve as a digital hub, the growing demand for data centre services, and the government’s supportive policies, including the Cloud First Policy initiative. Thailand’s Board of Investment (BOI) has also approved the long-term investment, recognizing its potential to bolster the nation’s digital infrastructure.

Numerous factors support Thailand’s emergence as a regional data centre hub. Powered by a high internet penetration rate of over 85% and the presence of social media user identities exceeding 65% indicate strong fundamental potential for the data centre business in the country. In addition, the planned investment of USD 500 million from one of the world’s largest digital infrastructure companies confirms Thailand’s position as a hot data centre destination in Southeast Asia.

Mr. Krit Pimhataivoot, Head of Capital Markets at Jones Lang LaSalle (Thailand) Limited (JLL), commented on the landmark deal, stating: “The increasing demand for high-quality data centre facilities in Thailand demonstrates the country’s growing importance as a hub for digital infrastructure in Southeast Asia. Data Centre is a highly risk-averse business where site selection criteria are highly detailed aiming to mitigate risks from all angles. We are delighted to have played a crucial role in facilitating the successful transaction of this prime plot.”

Mr. Krit also added “Thailand has significant potential to grow as the number of data centres and the MW capacity are still behind neighbouring SEA countries such as Indonesia and Malaysia. The expanding cloud infrastructure and data storage requirements coupled with an abundance of power availability and attractive incentives from The Board of Investment (BOI) are the key factors fuelling growth for Thailand’s data centre business. The Non-Tax Incentive on freehold land ownership for foreign investors from The BOI is one of the key factors triggering investment decisions for many global data centre players.”

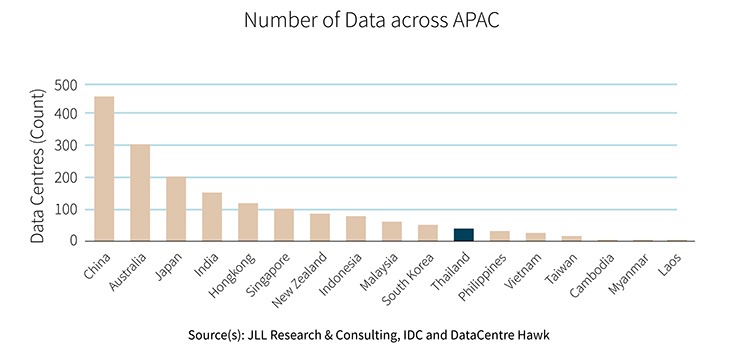

Mr. Michael Glancy, Managing Director for Thailand and Indonesia at Jones Lang LaSalle (JLL), added: “The data centre market in Asia has experienced rapid expansion, with a doubling in total capacity from 2,500 MW in 2022 to 5,000 MW in 2023. This substantial growth signifies the increasing demand for data storage and processing capabilities across industries in the region. In the Asia Pacific region, China leads with the highest number of Data Centres, totalling 448. Australia follows with 306 Data Centres, and Japan holds 218 Data Centres. This reflects the significant presence and investment in data Centre infrastructure within these countries while Thailand stands at only 39 Data Centres behind Malaysia at 55 DC and Indonesia at 79 DC. The potential to grow the sector in Thailand is vast especially as the digital economy continues to experience rapid growth, driven by technological innovation and strong government support for the development of digital infrastructure.”

Mr. Glancy also added “As the demand for digital services increases, Thailand’s strategic location and favourable investment environment make it an ideal market for data centre operators. We are proud to be a part of significant projects, which will contribute to the future of Thailand’s digital landscape.”

The data centre sector is one of the top asset classes driving demand for real estate, creating jobs, and boosting foreign investment in the Thai economy. In addition to data centres, hotels, industrial and logistics properties, and healthcare are key asset classes contributing to the growth of Thailand’s real estate sector this year. JLL has recently advised on the sale of Hyatt Regency Bangkok Sukhumvit, Thailand’s largest ever single hotel asset transaction. There are a few more significant landmark real estate transactions that JLL are advising and are expected to be completed later this year, primarily in the hospitality and data centre related businesses.

The data centre sector, alongside the other in-demand asset classes, continues to attract both Thai and foreign investors and is anticipated to drive further investment in the real estate market and the broader economy for Thailand. This trend is expected to extend into the first half of 2025.