Healthy Outlook for Long-Term Office Demand

as Multinational Companies in Asia Pacific Eye Expansion This Year

Bangkok – May 30, 2022 – In addition to resuming their search for the right office space, Thai employers are warming up to concept of hybrid working in line with the majority of Asia Pacific companies, which intend to retain the hybrid working arrangements even as employees return to the office on the back of easing COVID-19 restrictions, according to CBRE’s latest survey.

Ms. Maneerat Vichitrattana, Senior Director – Office Services, CBRE Thailand comments, “More office workers are returning to the office in Thailand. However, the return will not be to office life as we knew it pre-pandemic. Workplace priorities have shifted to support hybrid work, with measures ranging from changing the size and function of office portfolios to implementing new in-office features like hot desking and smart workplace technology. There is no ‘one size fits all’ strategy for companies; measures can differ across geographies, industries, and even individual teams in the same company.”

“Companies that had previously made plans to adopt full-scale working from home are now reconsidering their options, as a suitable office environment increases collaboration, efficiency, strengthens company culture, and contributes to achieving business goal.”

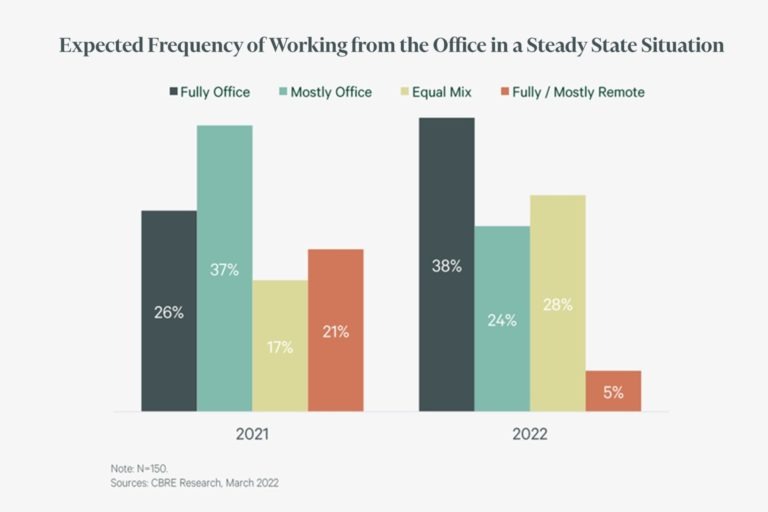

In addition, the survey of more than 150 Asia-Pacific companies by CBRE Research reveals that nearly 60% expect some form of hybrid working, ranging from an equal mix of office and remote working (28%) to mostly office (24%) to mostly or fully remote (5%). Nearly 40% of respondents expect staff to work fully from the office, up from 26% in 2021. This contrasts starkly with the U.S. and EMEA, where just 5% or fewer companies expect staff to fully work from the office.

The overriding preference for office-based working in Asia Pacific signals healthy long-term prospects for office demand, with nearly half of respondents intending to increase their real estate portfolios over the next three years, while 59% of multinationals plan to expand this year, up from 33% in 2021.

Moreover, the survey reveals a sharp drop in fixed seating arrangements in favor of flexible seating and activity-based working. Prior to the pandemic, 58% of firms had fixed seating. Post-pandemic, just 28% of companies have retained this practice. These preferences vary across industries, with the financial sector undergoing the strongest shift away from fixed seating, while professional services firms are likely to maintain more fixed seats, although some law firms are introducing unassigned private offices for confidential work.

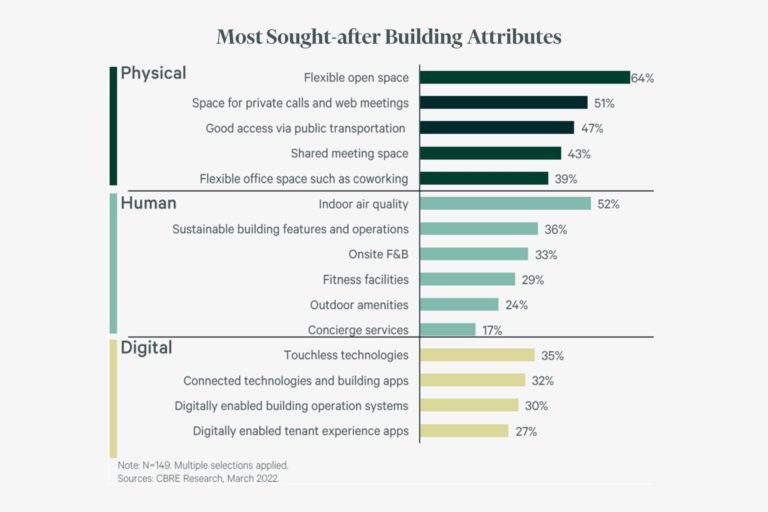

The adoption of hybrid working will require cutting-edge physical, human and digital amenities, with flexible open spaces (64%), good indoor air quality (52%), and touchless technology (35%) among the features that companies most want to incorporate in their buildings. About 60% of companies intend to increase their investments in technology in the workplace to provide a better experience for employees.

“Technology will be front and center of the hybrid working push, such as next-generation meeting facilities that can accommodate hybrid meetings, along with solutions that track office space optimization. To create this high-functioning ‘phygital’ workplace, occupiers will have to commit substantial investment and collaborate closely between internal functions and corporate real estate teams,” said Ms, Ada Choi, Head of Occupier Research and Head of Data Intelligence and Management, Asia Pacific for CBRE.