CBRE Thailand Unveils 2025 Outlook: Multispeed Recovery Defines Property Landscape

Bangkok – February 19, 2025 – CBRE Thailand, the leading international property consultant, shares: “Thailand begins 2025 on the back of continued investment in new large-scale mixed-use projects. While some sectors face weak demand and excess supply, others are benefitting from targeted government initiatives that have attracted investment and international tourists in increasing numbers.”

Ms. Roongrat Veeraparkkaroon, Managing Director of CBRE Thailand, stated, “The outlook for the hospitality and industrial sectors is very positive for the year ahead. While excess supply means 2025 will be a year of consolidation in the residential market, leasing activity is expected to remain strong in the commercial sectors. Overall, we are hopeful that domestic demand and financial liquidity will improve during the year, creating positive sentiment and generating increased market activity across all sectors.”

“The real estate market in Bangkok continues to evolve, presenting opportunities in markets with new supply and challenging developers to adapt their strategies. As Bangkok continues to attract international attention, we expect 2025 to be another eventful year,” added Ms. Chotika Tungsirisurp, Head of Research and Consulting at CBRE Thailand.

Residential

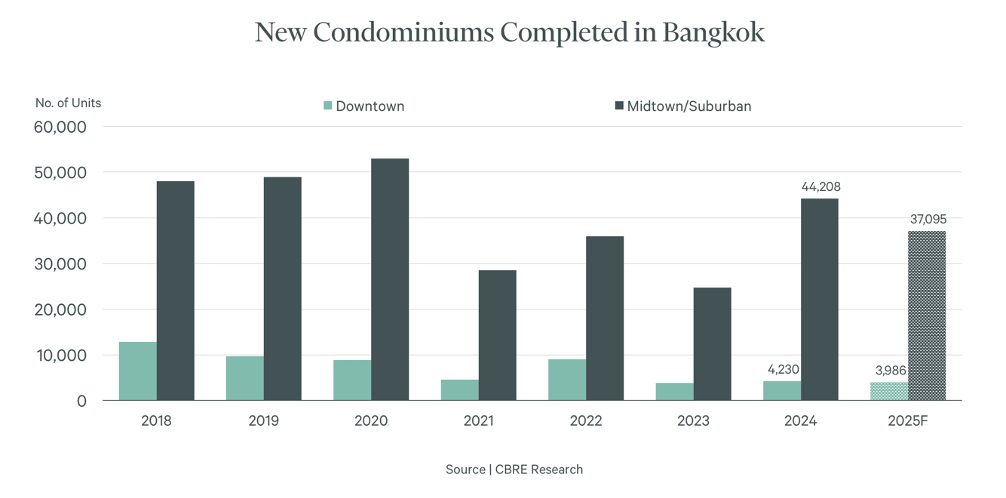

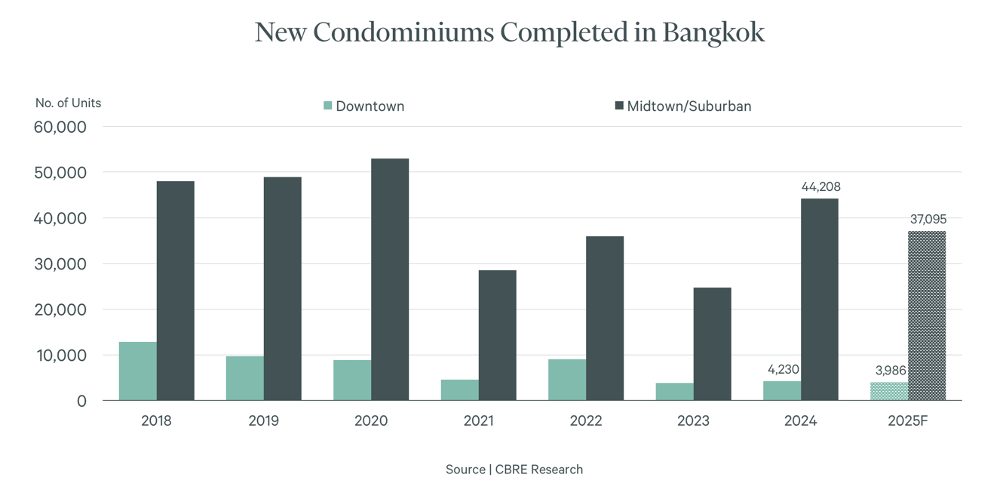

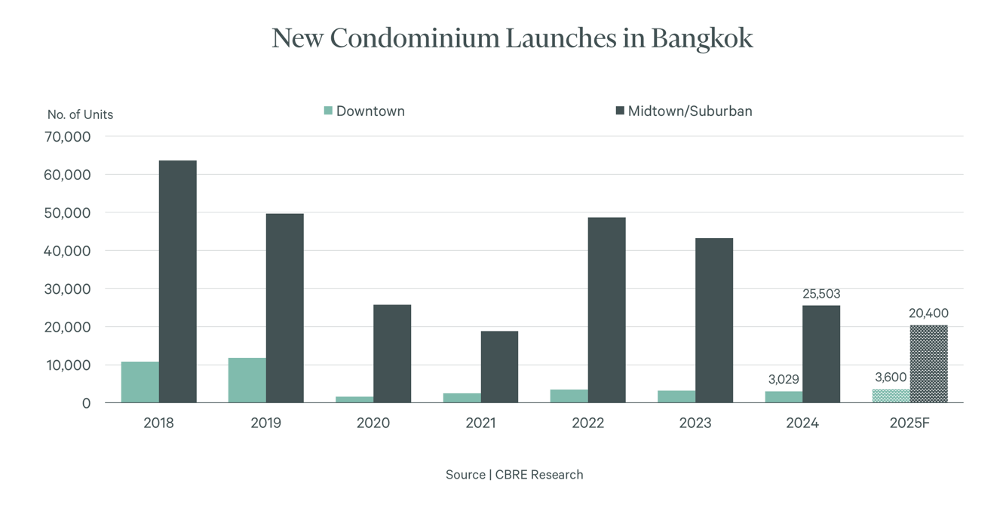

The residential sector in Bangkok is well-developed and heavily reliant on the domestic market. Difficulties in obtaining finance for both developers and buyers have severely limited new project launches and sales volumes.

The weak economic environment has compounded the issue, and many listed Thai developers have already announced very limited plans for new project launches in 2025. Having launched a significant number of condominium and housing projects in recent years, most developers are now focused on realizing their backlog and selling their unsold, ready-to-move-in inventory.

“Early signs for 2025 suggest increased activity in the downtown condominium market, particularly in the luxury and super-luxury segments, for both branded and non-branded projects. The target market will be a mixture of domestic end-user demand and foreign buyers seeking second homes, particularly from countries in the region. Several of these projects soft-launched in 2024 but will formally launch this year, having gained sufficient confidence from their targeted pre-launch marketing campaigns,” said Ms. Artitaya Kasemlawan, Head of Residential Sales – Project, CBRE Thailand.

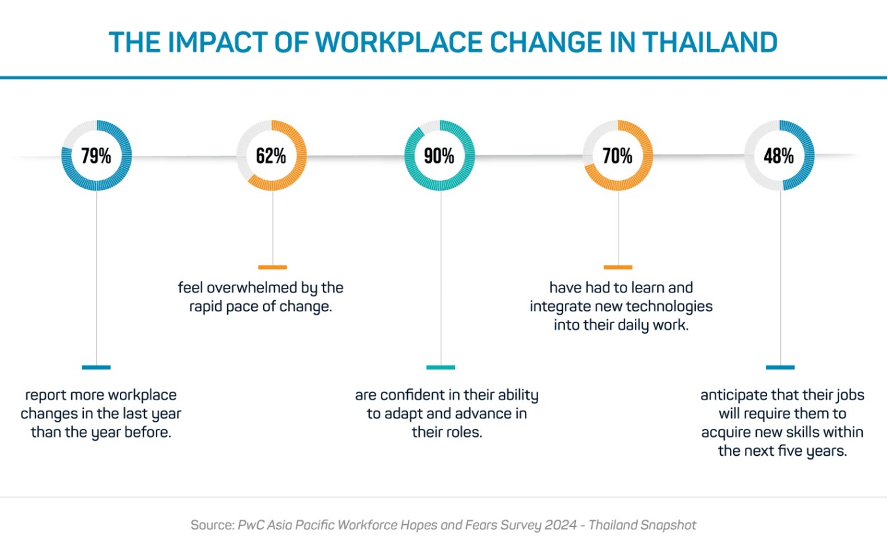

Office

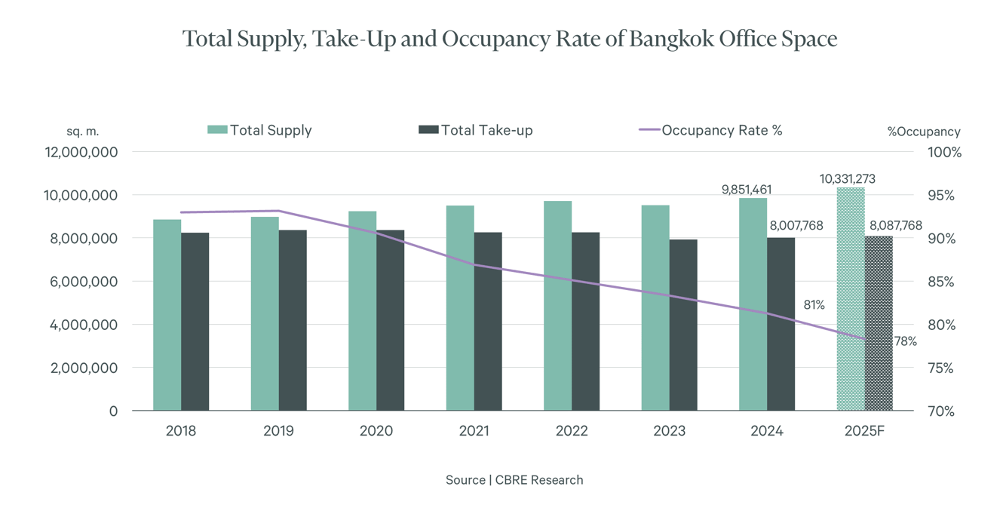

The Bangkok office market continues to see high-quality new supply entering at levels far exceeding demand. This new supply significantly impacts the overall market, allowing companies to choose between remaining in their existing premises or relocating. 2024 saw the highest level of net take-up in five years, with a combination of new setups and relocations from older buildings to recently completed, international standard, ESG-certified office buildings.

With vacancy rates expected to rise, competition for tenants will force landlords to adapt in a tenant-friendly market influenced by both a flight to quality and demand for value-for-money accommodation. To retain tenants and fill vacant spaces, many existing buildings will need to lower asking rents and invest in upgrades.

“It will be critical for office landlords to evaluate their asset management strategies for the medium to long-term prospects of their buildings, given the increased quality and competition brought by this new building supply,” added Mr. Nicholas Vettewinkel, Senior Director of Research and Consulting

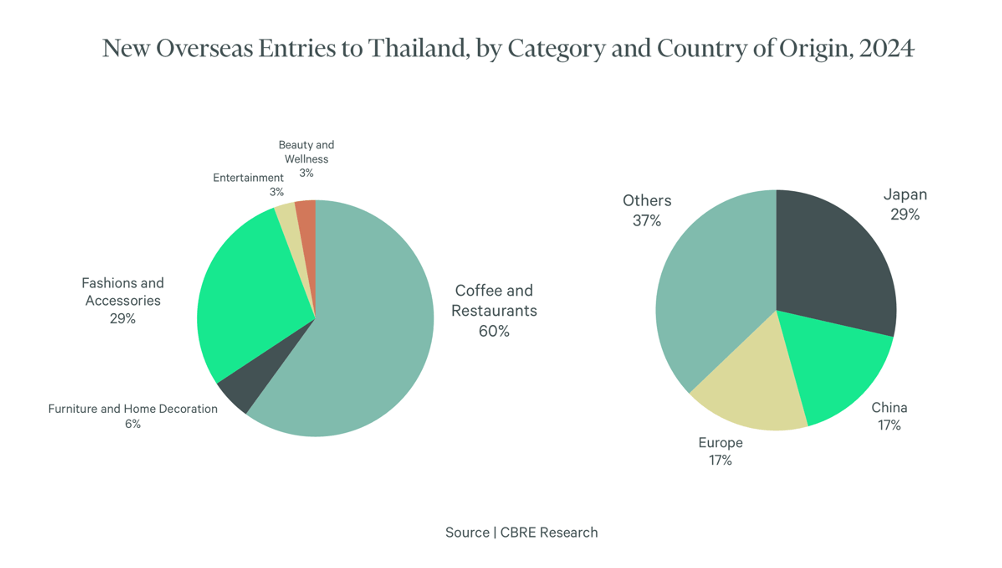

Bangkok’s retail market remains dynamic and lively, with downtown malls constantly enhancing their appeal to attract high-spending international tourists and boost mall performance. With more new supply expected to enter the market in 2025, the retail landscape will continue to be active. The market will see a steady supply of new enclosed malls across all areas of Bangkok in the coming years.

Many overseas brands recognize the growth potential, with demand expected to remain strong in core locations in 2025. The food and beverage segment is the dominant category for new overseas entries, with Japanese brands leading the way. Europe maintains a strong presence in the fashion and accessories segment. In addition, we expect further expansion from the wellness and entertainment industries to be incorporated into retail formats.

Hospitality

2024 was another strong year for the Thai hospitality sector, and in 2025, international tourist arrivals are expected to increase further, approaching the peak numbers achieved in 2019. This optimism is supported by improved flight capacity and sustained government initiatives to ease travel entry requirements. In 2024, visa-free travel was available to citizens of 93 countries, positively impacting overall hotel occupancy rates. Consequently, average daily rates and revenue per available room metrics for Bangkok also reached new highs in 2024.

We expect several new hotel brands to enter the market, especially in the upscale segment, further enhancing Bangkok’s appeal as one of the world’s most visited cities. With government initiatives to attract both tourists and long-stay guests through targeted long-term visa programs, we anticipate more mid- and long-stay brands opening in Bangkok.

Demand remains strong in the industrial sector, primarily within the EEC region and nearby provinces. Government initiatives to attract international companies through targeted incentives continue to yield results, particularly for land sales within industrial estates. This has, in turn, fueled demand from second- and third-tier suppliers for ready-built factories.

It’s noteworthy that demand is strong across a broad array of industries and from a wide variety of countries, including domestic demand. The logistics sector is experiencing increased competition as new developers enter the market, providing high-quality modern space to meet growing demand.

To read the full report, visit the CBRE website.