In mid-January, Thailand was the second country globally to be impacted by the COVID-19 virus outbreak. Initially, the number of infected individuals developed at a comparatively low rate. However, in recent days, this has accelerated, and the government is actively implementing “social distancing” policies which are impacting our businesses. To assist you with your business decisions, we have addressed some of the key issues that many businesses are facing at the moment. In this update, we have selected the following topics:

- Employment Matters

- Work Permits and Visas

- Social Security Fund Measures

- Other Employment Matters

- Tax Measures

- Corporate Secretarial Matters

- Accounting Matters

On Tuesday, 24 March 2020, the government announced that it will declare an emergency decree and introduce new measures on Thursday. We will keep you informed as and when there are further updates. I trust this update is helpful for planning your short-term business action. If you have any additional questions, please don’t hesitate to contact us. Rob Hurenkamp Managing Partner 2 Employment Matters We first address how the labour law currently applies in case an employee is unable to work as a result of the COVID19 virus.

1. COVID-19 is a dangerous communicable disease as defined in the Communicable Diseases Act, 2558 B.E. If an employee is infected and takes leave, the employee is entitled to sick leave for the number of days sick, but cannot receive pay for more than 30 days under the labour law.

2. If an employee is at risk of having been infected and must be quarantined, labour law does not apply to the days in quarantine. An employer must order the employee to stay home and use annual leave first. If the amount of annual leave is not sufficient to cover the time in quarantine, the employee cannot receive wages for those additional days if the employee cannot work from home and the employee’s illness was not a result of performing work for the employer.

For businesses that are faced with having to close either temporarily or permanently, reduce operations, and / or cut salaries, there are number of options available.

3. Bangkok and a number of other provinces have already ordered certain types of businesses to close temporarily in order to help reduce the spread of COVID-19. An employer that is required to suspend its business operations does not have to pay wages to its employees during this period.

4. Under Section 30 of the Labour Protection Act, an employer must provide at least 6 days of annual leave for employees who have worked for at least 1 year. Therefore, if employees agree, businesses may ask them to take their annual leave during a temporary reduction in business activities.

5. Under Section 75 of the Labour Protection Act, if the employer cannot operate its business normally for reasons other than force majeure, the employer may temporarily suspend the business in whole or in part. In this case, employees are entitled to at least 75% of the wages that they would have received on normal working days for the entire period that the employer does not require them to work. The employer must give the employee and the Labour Inspector written notice of the suspension of business at least 3 working days in advance, and must also report this temporary closure to the Social Security Fund, as no contributions will be made during that period.

6. The employer and employee may both agree in writing to a reduction in wage. Under Section 20 of the Labour Relations Act, 2518 B.E. (1975), any change in the terms and conditions of employment requires the written consent of employees.

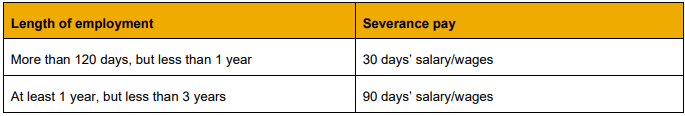

7. There are many businesses across a wide range of industries that are severely affected by COVID-19 and which will have to lay off their employees. In this case, the laid-off employees shall be entitled to severance pay, payment in lieu of advance notice, and unused annual leave, but cannot claim additional compensation for unfair dismissal. An employer that terminates the employment contract of an employee must provide severance pay as prescribed in Section 118 of the Labour Protection Act. The severance pay rates are as follows:

Work Permits and Visas

International travel is extremely difficult at this time, with many airlines having ceased or planning to cease operations. Many countries have already gone into lockdown, and entry is not permitted. It is also now very difficult to enter Thailand, as the Thai government requires health insurance coverage and a health certificate before passengers can check in, which are not possible to obtain in many countries. Currently, domestic travel in Thailand is still possible, as the government has not announced a national emergency or proclaimed martial law, but those relocating from one province to another must self-quarantine.

The Labour Department and Immigration Office are still open and provide services as normal. Therefore, people are still required to go there to extend work permits and visas. However, the work permit application must now be submitted at the District Labour Office (rather than the Ministry of Labour). There are also limits on the number of daily visitors to those offices, for example, a maximum 50 visitors at the One Stop Service Centre and a maximum 100 visitors at the Immigration Office. A work permit and visa can be extended 30 days prior to the expiry date, we therefore recommend doing it as early as possible.

1. Visas

The Royal Thai Police has not yet issued any formal announcements on visa extensions. There are restrictions on flying into Thailand, and the government has announced that land border crossings will be closed. It is almost impossible to leave the country to extend a visa.

If you leave the country and need to re-enter, the Thai government requires anyone entering Thailand to have their temperature checked with a thermal scanner, have a health control check, and self-quarantine for 14 days. In addition, the CAAT requires the following:

(i) A health certificate issued no more than 72 hours before the date of arrival, stating that the person does not have COVID-19.

(ii) Health insurance coverage in Thailand of at least USD 100,000 for COVID-19.

(iii) Filling out Form T8 at the port of entry.

Under point 2.28 of Immigration Order 327/2557, a foreigner can apply for a 30-day extension by doing the following:

(iv) Filling out Form TM7 for extending the visa

(v) Providing a copy of his or her passport

(vi) Providing a letter from his or her embassy or consulate requesting that the Royal Thai Police, Immigration Bureau, allow the foreigner to stay in the country longer. The letter must explicitly state that the foreigner is unable to travel due to the COVID-19 outbreak.

2. 90-day Reporting

There is an online application but, in our experience, it is rarely reliable: https://extranet.immigration.go.th/fn90online/online/tm47/TM47Action.do Therefore, it is advisable that foreigners continue to make a 90-day report in person at the immigration office, or use a representative to submit the notification.

3. Work Permits

There is no change in the regulations. An applicant can apply to renew a work permit 30 days prior to the expiration date of the existing work permit at the Department of Employment of each area.

Social Security Fund Measures

The Social Security Board approved the following measures on 20 March 2020. They are expected to be approved by the Cabinet on 24 March 2020.

1. A reduction in Social Security Fund contributions from 5% to 4% for both employees and employers from March to August.

The deadlines for paying monthly contributions for March, April, and May have been deferred for three months. Therefore, the contributions for March must be paid no later than 15 July 2020.

2. Employees who have been made redundant because their employer has ceased operations will receive 50% of their wage, capped at 15,000 baht per month, for a maximum of 180 days.

3. Employees that have had their employment suspended because of a temporary business closure as a result of a government order will receive 50% of their salary, capped at 15,000 baht per month, for not more than 60 days.

4. An increase in unemployment benefits:

- For resignation, from 30% to 45% of one’s wage, up to a maximum of 90 days.

- For termination, from 50% to 70% of one’s wage, up to a maximum of 200 days. The cap is 15,000 baht per month.

Other Employment Matters

Songkran holiday postponed

On 17 March 2020, the Cabinet announced that the Songkran holiday (13 to 15 April 2020) was postponed.

Section 29 of the Thai Labour Protection Act states that employers must provide at least thirteen (13) annual holidays and announce them to employees in advance, including Labour Day, as prescribed by the Minister. In addition, employers must fix these holidays in accordance with official annual holidays, religious, or local traditional holidays.

Therefore, as a result of the Songkran holiday being officially postponed, in accordance with Section 29 of the Thai Labour Protection Act, 13 to 15 April 2020 will not be observed as a local traditional holiday nor observed as a holiday by the private sector.

In addition, the Bank of Thailand recently revised the holidays for financial institutions, cancelling the holiday scheduled for 13 to 15 April 2020. Substitute holidays will be announced later.

Tax Filing

As of today, there are no changes in the withholding tax, VAT, and corporate income tax filing deadlines.

Tax Measures

The Cabinet approved

the following tax measures on 10 March 2020 to help boost the economy during the COVID19 outbreak. These are yet to be announced in the Royal Gazette.

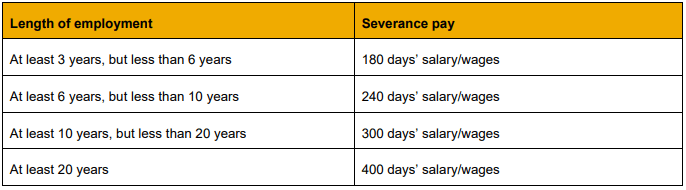

1. Reduction in withholding tax rates

The withholding tax rate for service fees, such as those for the hire of work, services, commissions, and professional fees, will be reduced, as shown in the table below. Those who will receive the benefits from this tax measure include individuals, companies, and partnerships.

Withholding tax rates for other things, such as transportation, rental, dividends, and interest, will not be reduced by this tax measure.

2. Deduction of 1.5 times interest expenses

A company that has taken out low-interest loans (soft loans) can claim a tax deduction of 1.5 times the interest expense paid from 1 April 2020 to December 2020.

The company must meet the following conditions:

▪ It must have taxable income of not more than 500 million baht from its business in the last 12-month accounting period, where the last day of the accounting period ended on or before 30 September 2019.

▪ It must have not over 200 employees. In order for a company to claim this deduction, it must register with the Revenue Department under the procedures set out for a tax amnesty.

3. Deduction of 3 times wage expenses

A company that does not lay off employees or reduce staff can claim a tax deduction of 3 times the wage expenses paid from April 2020 to July 2020. The company must meet the following conditions:

▪ It must have taxable income of not more than 500 million baht from its business in the last 12-month accounting period, where the last day of the accounting period ended on or before 30 September 2019.

▪ It must have not over 200 employees

▪ It must retain those employees who are registered with the Social Security Office, and their monthly wages must not be over 15,000 baht.

▪ The number of current employees must not be lower than that in December 2019.

4. Early VAT refunds for goods exporters

An exporter of goods as defined in Departmental Regulation Tor.490/2562 which has capital of over 10 million baht will receive a VAT refund earlier than normal, as follows: ▪ Within 15 days if filing electronically ▪ Within 45 days if filing on paper

5. Deduction of expenses for donations for COVID-19

Individuals, companies, and partnerships that make a donation electronically to the Office of the Permanent Secretary, Prime Minister’s Office, to help fight the COVID-19 virus between 5 March 2020 and 5 March 2021 can deduct the expenses for such a donation (not exceeding 10% of net income for an individual and not exceeding 2% of net income for companies or legal partnerships). The donation is also exempt from VAT.

Corporate Secretarial Matters

1. Annual General Meeting

A limited company must hold an Annual General Meeting (AGM) within four months of the fiscal year-end in order to consider and approve the audited financial statements and other matters, as required by law (such as the rotation of directors), and as stipulated in the Articles of Association (AoA) of the company. As of today, the Department of Business Development (DBD) has announced that private and public limited companies which cannot hold board or shareholders’ meetings by the deadline prescribed by law due to the COVID-19 outbreak must submit a letter to the DBD stating that this is the reason the meetings cannot be held. The DBD will consider and approve delays in holding such meetings on a case-by-case basis.

2. Filing audited financial statements and lists of shareholders

Limited companies with an accounting period ended 31 December 2019 must file their lists of shareholders and financial statements with the DBD through its electronic system.

▪ Lists of shareholders as of the AGM must be filed within 14 days of the date of the AGM.

▪ Financial statements must be filed within 1 month of the date of the AGM.

A foreign legal entity, such as a representative office or branch office, must file its audited financial statements within 5 months of the fiscal year-end. For an accounting period ending 31 December 2019, this would be 31 May 2020. The DBD has not yet issued an official announcement on extending these deadlines.

Accounting Matters

Accounting Implications of COVID-19

COVID-19 has already had a significant impact on global financial markets, and there may be accounting implications for many entities.

Below are some key issues that entities preparing financial statements applying full TFRS or TFRS for NPAEs for periods ending on or after 31 December 2019 should consider. These do not address management or risk reporting, which also need to be considered.

Some of the key factors that will be affected include:

▪ Interruptions of production

▪ Supply chain disruptions

▪ Unavailability of personnel

▪ Reductions in sales, earnings, or productivity

▪ Closures of facilities and stores ▪ Delays in planned business expansions

▪ Inability to raise financing

▪ Reduced tourist numbers, disruptions in nonessential travel and sports, cultural, and other leisure activities

In addition, it may be appropriate for entities to consider the possible impact of the outbreak on accounting conclusions and disclosures related to the following areas:

▪ Allowances for doubtful accounts

▪ Valuation of inventories

▪ Restructuring plans and the breach of loan covenants (including impact on the classification of liabilities as current vs non-current)

▪ Going concern issues

▪ Events after the end of a reporting period

▪ Employment termination benefits

Please note that, as a non-adjusting event, the impact of the COVID-19 outbreak should not be factored into the financial statement balances and accounts as of 31 December 2019, but will impact disclosures, including those related to subsequent events, going concern issues (if the entity is no longer viewed as a going concern) and sources of estimation uncertainty.

| Issue | Comments |

| In their assessment, management could consider the actual and projected foreseeable impact of various factors, such as the following: ▪ Significant decline in revenue; ▪ Significant erosion of profits due to higher costs or incurring unforeseen expenses; ▪ Costs or incurring of unforeseen expenses; ▪ Breach of debt covenants consequent to the adverse impact on its financials; and ▪ Cash flow issues. An entity shall not prepare its financial statements on a going concern basis if management determines, after the reporting date, on the basis of the assessment above, that it intends to liquidate the entity or to cease trading, or that it has no realistic alternative but to do so. Furthermore, disclosures are required when the going concern basis is not used or, if the going concern assumption is maintained, when management is aware of material uncertainties relating to the entity’s ability to continue as a going concern. | |

| Subsequent events Financial statements as at 31 December 2019 | Considering information that was available as at the 2019 year-end, the management must consider the COVID-19 outbreak as a non-adjusting event in the 31 December 2019 financial statements. TAS 10 and paragraph 315 of TFRS for NPAEs – events after the reporting period These events include those, both favourable and unfavourable, that occur between the end of the reporting period and the date on which issue of the financial statements is authorized. The two types of events are: (i) those that provide evidence of conditions that existed at the end of the reporting period (adjusting events); and (ii) those that are indicative of conditions that arose after the reporting period (non-adjusting events). |

| Subsequent events Financial statements as at 31 December 2019 | As the COVID-19 outbreak became public knowledge and began to have an impact after 31 December 2019, it is proposed that the impact of COVID-19 be considered a non-adjusting event. However, if non-adjusting events after the reporting period are material, the entity should disclose these matters in their 31 December 2019 financial statements. Areas to consider ▪ Impairment / write-down of assets (receivables, inventory, etc) ▪ Fair value measurements ▪ Provisions for onerous contracts ▪ Breach of debt covenants ▪ Provisions ▪ Going concern If the impact of the COVID-19 outbreak is material, the entity is required to disclose the nature of the impact and an estimate of its financial effects. |

| Financial statements of periods ending after 31 December 2019 | Management needs to consider the possible accounting implications of their response to the COVID-19 outbreak: ▪ Management may proactively engage their debtors and creditors in reviewing payment terms and conditions. It is important to assess whether any significant change in such terms and conditions would result in a modification or extinguishment of the financial instrument which would have different accounting implications. ▪ Entities may also contact their banks in regard to the debt covenants for their borrowings and assess whether a waiver of any breach of the debt covenant and/or certain changes in the debt covenants may be necessary. A breach of a debt covenant may trigger a clause for repayment on demand that may be included in the loan agreement, which gives the bank the right to demand repayment at any time, at its sole discretion. This could have an impact on the classification of current/non-current bank borrowings, and consequently trigger other events. Should a waiver be deemed necessary, it is important to note that the waiver must be obtained from the bank as of the reporting date to avoid the reclassification of the non-current bank borrowings. Disclosure will be key for many entities, as the impact of COVID-19 involves significant judgement. Disclosures should allow the users of financial statements to identify the key assumptions made about the impact of the outbreak on material estimates and the main sources of estimation uncertainty that could result in material adjustments to the carrying amount of assets and liabilities. Whenever possible, an entity should provide a sensitivity analysis or a range of outcomes (see below). |

| Disclosure of sources of estimation uncertainty (including risks) | TAS 1 requires the disclosure of assumptions made about the future and of other major sources of uncertainty creating a significant risk of a material adjustment to the carrying amounts of assets and liabilities within the ensuing financial year. Specifically, disclosure relates to estimates that require management’s most difficult, subjective, or complex judgments and should include the following: 1. the nature of the assumptions or other estimation uncertainty; 2. sensitivity of carrying amounts to the methods, assumptions, and estimates underlying their calculation; and 3. the expected resolution of the uncertainty and the range of reasonably possible outcomes within the next financial year. While it may not be practicable to determine the extent of the possible effect of an assumption or other source of 10 estimation uncertainty on a particular asset (or group of assets) or liability, IAS 1 requires identification of the asset or liability (together with disclosure of its carrying amount) and a statement to the effect that it is reasonably possible, on the basis of existing knowledge, that outcomes within the next financial year will be different from the assumptions now being made (i.e., which could require a material adjustment to the asset’s or liability’s carrying amount). |

| Other financial communications from the regulators | 1. The Securities and Exchange Commission of Thailand (“SEC”) allows listed companies with their core business in countries affected by the COVID-19 outbreak to postpone the submission of financial statements on the condition that a written request is submitted for the SEC’s consideration on a case-by-case basis before the submission deadline expires. In addition, the SEC has indicated that it will grant listed companies, with a financial year-end of 31 May 2020, an extension of their filing deadline to 150 days after year-end, which is increased from the standard 60 days. Currently, listed companies with a financial year-end of 31 May 2020, are still required to submit their full-form annual report no later than four months after their financial year-end. However, the SEC are reviewing this requirement. For listed and regulated company quarterly reporting for the period ending 31 March 2020, no additional guidance has yet been issued by the SEC. 2. The Office of Insurance Commission (“OIC”) allows insurance companies (life or non-life insurance) that are affected by the COVID-19 outbreak to postpone the filing of financial statements and operation reports on the condition that a written request is submitted for the OIC’s consideration on a case-by-case basis before the filing deadline expires. The extension of submission is within 30 days after the regular deadline except for other conditions that the OIC has approved. |

![Mazars (Thailand) Ltd. [Converted] Mazars (Thailand) Ltd. [Converted]](https://www.austchamthailand.com/wp-content/uploads/elementor/thumbs/Mazars-Thailand-Ltd.-Converted-q0uio6uhbr8drfmh3ksuc2fmzt8xqfp54mzp5bfwvg.png)