Following the enactment of the Emergency Decree on the Digital Asset Businesses B.E. 2561 (A.D. 2018) (“Digital Asset Businesses Decree“) and the Emergency Decree on the Amendment of the Revenue Code (No. 19) B.E. 2561 (A.D. 2018) (“Amendment of the Revenue Code Decree“), which became effective on 14 May 2018, the Office of the Securities and Exchange Commission (SEC) held a public hearing on the draft of related sub-regulations to be issued under the Digital Asset Businesses Decree on 16 – 30 May 2018. These sub-regulations are expected to be officially issued within June 2018.

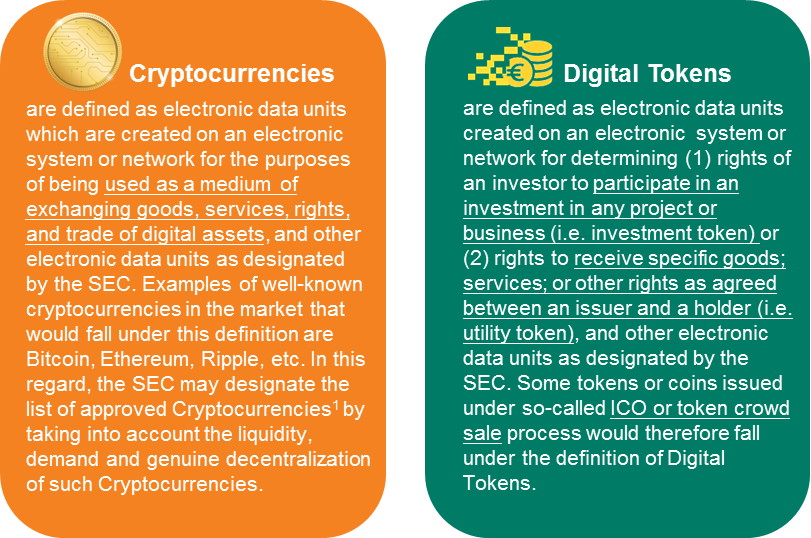

Here is the overview of how Digital Assets, which comprise of Cryptocurrencies and Digital Tokens (e.g. those raised through so-called ICOs or token crowd sales), are to be regulated and taxed in Thailand.

1. What is the legal status of Cryptocurrencies and Digital Tokens?

Digital Assets comprise of two categories of assets, namely “Cryptocurrencies” and “Digital Tokens“.[1]

2. What is the overview of the regulatory landscape?

Regulated activities include (1) offering of Digital Tokens to the public and (2) operation of Digital Asset Businesses.

(1) Offering of Digital Tokens to the Public

An issuer must obtain prior approval from the Office of the SEC before offering its Digital Tokens to the public and must file a registration statement and draft prospectus to the Office of the SEC. The offering of Digital Tokens can only be done once the registration statement and the prospectus have become effective and can only be done through SEC approved ICO Portal to investors.

Under the latest draft regulations, which may be subject to change; the offering of utility tokens that do not have characteristics for raising funds that could be utilized since the first date of offering, will be exempted from offering requirements.

For cross-border deals, including outbound or inbound investment or outbound or inbound offering of tokens, careful considerations under this law and other relevant laws including exchange control law and tax must be done on a case-by-case basis.

(2) Operation of Digital Asset Businesses

Digital Asset Businesses include (1) Digital Asset Exchange[2], (2) Digital Asset Broker[3], and (3) Digital Asset Dealer[4], or any other businesses as designated by the Minister of Finance. All these operators must obtain an approval from the Ministry of Finance (MOF) through the Office of the SEC and must comply with certain regulatory requirements.

Under the latest draft regulations, which may be subject to change; the provision of services as a center for (i) trading Cryptocurrencies that are considered as a stable coin/reference coin ( i.e. Cryptocurrencies of which the value always pegs with and equals to the specified value of Thai Baht, without the element of fluctuation), and (ii) exchanging utility tokens with the same type of other utility tokens that could be immediately utilized, will not be regulated under this law.

3. What role can you play and what are the implications?

- Public offering of newly offered Digital Tokens must be done by a company (either private or public) established in Thailand.

- Issuer must file a registration statement and a draft prospectus to obtain approval from the Office of the SEC prior to the offering.

- Offering must only be done through an approved ICO Portal and Digital Tokens may only be offered to certain types of investors that meet the requirements, qualifications, and limitations as specified by the Office of the SEC.

- the issuer must comply with several obligations, e.g. provide an explicit business plan and audited financial statements, disclose material information (e.g. rights of the holder of Digital Tokens), unveil the source code to be used in the ICO process, periodical report about the progress of the project, and etc.

- the offering may be one-time or shelf offerings (one of the key focus point for the hearing)

- the issuer can only receive “Thai Baht” or “Cryptocurrencies listed by the Office of the SEC”.

offering limit for retail investors in a deal: the higher of (1) ≤ 4 times the shareholders’ equity of the issuer; or (2) ≤ 70% of the total offering amount

- An ICO Portal business requires approval from the Office of the SEC.

- The roles of ICO Portals are similar to FAs in traditional deals and funding portals in equity crowdfunding deals. ICO Portals are to conduct analysis to ensure characteristics of the Digital Tokens to be offered, the qualifications of the issuer and the accuracy of the registration statement and prospectus, as well as the accuracy of any information disclosed on the ICO Portal as required by the Office of the SEC.

- ICO Portals will be considered as ‘Financial Institutions’ under AML/CTF laws and must comply with several obligations, including KYC/CDD and transaction reporting, etc.

- Under the latest draft regulations, which may be subject to change:

- ICO Portal must be a company (either private or public) established in Thailand with a registered capital of not less than THB 5 million and with a proper management structure and working systems to support the tasks of an ICO Portal.

- Under the latest draft regulations, which may be subject to change: investors can invest up to the following investment limits:

- For public offerings of Digital Tokens:

- For Institutional Investors, Ultra High Net Worth Investors, Private Equity Funds, Venture Capitalists, and Qualified Investors: No limit.

- For Retail Investors: 300,000 THB per person per offering.

- For trading Cryptocurrencies or Digital Tokens in an Exchange or with a Dealer or a Broker: No limit

- For public offerings of Digital Tokens:

- Prior approval from the SEC for relevant types of businesses, namely Digital Asset Exchange, Digital Asset Broker, and/or Digital Asset Dealer, must be obtained and several requirements must be complied with prior to the commencement of the business operation such as maintaining sufficient funds to operate the business, proper KYC/CDD, cyber security, and for certain types of business operators, requirements regarding asset safekeeping and fair marketplace.

- For existing business operators, there is a 90-day transitional period (i.e. with the current deadline being 14 August 2018) to apply for approval and to bring their businesses into compliance with the new regulatory requirements.

- Under the latest draft regulations, which may be subject to change: Digital Asset Businesses must be established in Thailand and must comply with several regulatory requirements to be able to submit a license application[5] for each Digital Asset Business as follows:

- Digital Asset Exchange must have its shareholders’ equity ≥ THB 50 million and must conduct a product screening and proper KYC/CDD, maintain appropriate cyber security systems, asset safekeeping and fair marketplace.The license fee for operating an exchange of Digital Tokens: THB 2.5 million and the same amount of fee is applicable for operating an exchange of Cryptocurrencies. The annual fee is 0.002% of the total trading value and the annual fee is in the range of THB 0.5 million – THB 20 million.

- Digital Asset Broker must have its shareholders’ equity ≥ THB 25 million and must take into account client suitability, conduct a proper KYC/CDD, maintain appropriate cyber security systems, and asset safekeeping.

The license fee for brokers of Digital Tokens: THB 1.25 million and the same amount of fee is applicable for brokers of Cryptocurrencies. The annual fee is 0.001% of the total trading value and the annual fee is in the range of THB 0.25 million – THB 10 million.

- Digital Asset Dealer must have its shareholders’ equity ≥ THB 5 million and has its key role to conduct proper KYC/CDD and maintain appropriate cyber security systems.

The license fee for dealers of Digital Tokens: THB 1 million and the same amount of fee is applicable for dealers of Cryptocurrencies. The annual fee is 1% of the profit from the dealing of Digital Assets and the annual fee is in the range of THB 0.1 million – THB 5 million.

4. How are Digital Assets Investors Protected?

In order to prevent any unjust or unfair trading of Digital Assets taking place in a Digital Asset Exchange, the Decree imposes several offenses including penalties against several unfair market practices similar to traditional securities regulations such as the dissemination of false information, tipping, insider trading, front running and market manipulation.

Unauthorized offering of Digital Tokens or unauthorized operation of a Digital Asset Business are also subject to criminal liabilities.

Furthermore, in order to enhance the effectiveness of enforcement of the law on Digital Assets, this Decree also takes on a similar concept to securities law in imposing civil sanctions such as civil fines and the compensatory disgorgement of unjustly gained benefits.

5. Tax Implications

Overview of the new tax law on Digital Assets

The Amendment of the Revenue Code Decree amended the Revenue Code by adding new types of income and imposing withholding tax obligation with regards to Cryptocurrencies and Digital Tokens.

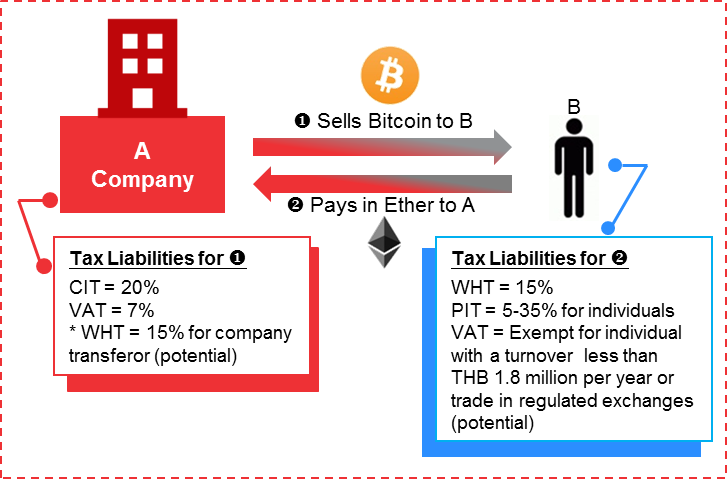

A share of profit or any benefit derived from holding or having possession of Digital Tokens is regarded as taxable income under Section 40(4)(h) of the Revenue Code and capital gain from the transfer of Cryptocurrencies or of Digital Tokens is regarded as taxable income under Section 40(4)(i) of the Revenue Code.

Any individual (both Thai and non-Thai tax residents) who derives income as mentioned above will be subject to a withholding tax at the rate of 15 percent. It is important to note that the 15% withholding tax is not a final tax, which means that the individual recipients will still be required to include such income into their personal income tax return filing. Net income (i.e. taxable income less deductible expenses and allowances) is subject to personal income tax at progressive rates of 5% to 35%. The 15% withholding tax is creditable against the personal income tax payable.

Although the Amendment of the Revenue Code Decree does not cover tax imposed on Thai and non-Thai tax resident corporate entities, the 15% withholding tax will be imposed on non-Thai tax resident corporate entities under the existing tax law (Section 70), while Thai tax resident corporate entities would be required to include such income in their corporate income tax return filing. Net profits (i.e. taxable income less deductible expenses) are subject to corporate income tax at 20%.

On 15 May 2018, the Ministry of Finance and the Revenue Department held a press conference to explain the Amendment of the Revenue Code Decree. At the press conference, the Revenue Department explained that Digital Assets are regarded as intangible assets under the existing VAT law; therefore, the trading of Digital Assets would be subject to VAT.

According to the press conference, the Revenue Department will issue subordinate pieces of legislation in the near future to determine the withholding tax rate for corporate entities, which is likely to be at 15% and to exempt VAT on the trading of Digital Assets by individuals through authorized exchanges.

However, an ICO issuer will be subject to both corporate income tax and VAT as a result of the ICO. This means that the ICO transaction, i.e., an ICO issuer issuing Digital Tokens in exchange for either cash or Cryptocurrencies from investors, would potentially trigger taxes on both ICO issuer and investors. Nevertheless, the tax regulation on Digital Assets may change in the near future to ease the tax liabilities on ICO issuers and to promote the Thai Digital Economy.

Scenarios and tax liabilities

- Cryptocurrency for cryptocurrency

- ICO for cryptocurrency

- Digital tokens for cryptocurrency

Potential Issues

From our analysis, there are some potential taxation issues that may arise from the application of the Amendment of the Revenue Code Decree as addressed below, if there are no subordinated regulations addressing these issues otherwise.

- Risk of incorrect tax withholding

In order for the buyer of Digital Assets to withhold tax correctly, a seller must provide evidence of the cost of Digital Assets sold to a buyer. There may be complications in case the Digital Assets were acquired at different times and the exact cost could not be clearly identified. This would result in the buyer withholding tax incorrectly and being liable to withholding tax shortfall and surcharges.

- Lack of conversion methods

Taxable gains from the transfer of Digital Assets may occur from the exchange of one type of Digital Asset for another (e.g., the exchange of Bitcoin for Ripple). In this case, it is possible that both exchanging parties will derive gains from the transfer of Digital Assets, and are both obliged to withhold tax. The Amendment of the Revenue Code Decree does not clearly determine the method for conversion of Digital Assets into THB for the calculation of gains for withholding tax purposes. As there are various exchanges for Digital Assets in Thailand with varying exchange rates that may cause some practical issues relating to the conversion of Digital Assets for withholding tax purpose.

- Increased burden for the payment made by Digital Assets

Nowadays, Digital Assets may be used to purchase goods or services. A purchaser may be deemed to derive gains from the transfer of Digital Assets, and a seller would therefore be obliged to withhold and remit tax to the Revenue Department under the Amendment of the Revenue Code Decree. This would create burden for the seller to obtain the information on the cost of Digital Assets, as well as the market price of the goods and services supplied, to calculate gains from the transfer. This would discourage the use and the acceptance of Digital Assets as a mean of payment for the purchase price. There would also be complications if the goods or services supplied do not have a market price. For example, when Cryptocurrencies are used to exchange for newly issued Digital Tokens that do not have a market price.

We understand that the relevant authorities are drafting regulations to address several issues. It is important to find the best solution and create efficient and fair mechanism to collect tax relating to Digital Assets.

We believe the laws and regulations relating to Digital Assets will continue to be developed through times similar to other jurisdictions. Our FinTech team will continue to monitor the legal and regulatory developments and trends in FinTech areas.

[1] According to the news regarding the office of the SEC’s meeting on 7 June 2018, the SEC will designate 7 cryptocurrencies in its first list of approved Cryptocurrencies, used for Initial Coin Offerings (ICOs) or to be traded as trading pairs. These approved cryptocurrencies consist of Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Ripple, and Stellar.

[2] “Digital Asset Exchange” means a center or a network established for the purposes of purchasing, selling or exchanging of Digital Assets, operating by matching or arranging the counterparties or providing a system or facilitating a person who is willing to purchase, sell or exchange Digital Assets to be able to enter into an agreement or match the order, in the normal course of business, but not including the system or network as specified by the Office of the SEC.

[3] “Digital Asset Broker” means a person who services or holds himself out

to the public as available to be a broker or an agent for any person in the purchase, sale or exchange of Digital Assets to other persons in the normal course of business, in consideration of a commission, fee, or other forms of remuneration, but not including brokers or agents in the manner as specified in the notification of the SEC

[4] “Digital Asset Dealer” means a person who services or holds himself out to the public as available to purchase, sale or exchange of Digital Assets for his own account in the normal course of business outside a Digital Asset Exchange, but not including dealers in the manner as specified in the notification of the SEC.

[5] The License application fee for operating each of Digital Asset Businesses is THB 30,000