New Variant Good or Bad, Negative Liquidity to Impact Asset Values

US Government turns off the Liquidity Tap

As we reached the end of November yesterday, we face quite a daunting prospect - not the Omicron variant of COVID (which we don’t yet know whether this represents really good news, really bad news or somewhere in between) but the prospect of a month in which the US Government, instead of providing support for the American economy and Capital markets during a vulnerable time, will prove to be a drag on them instead.

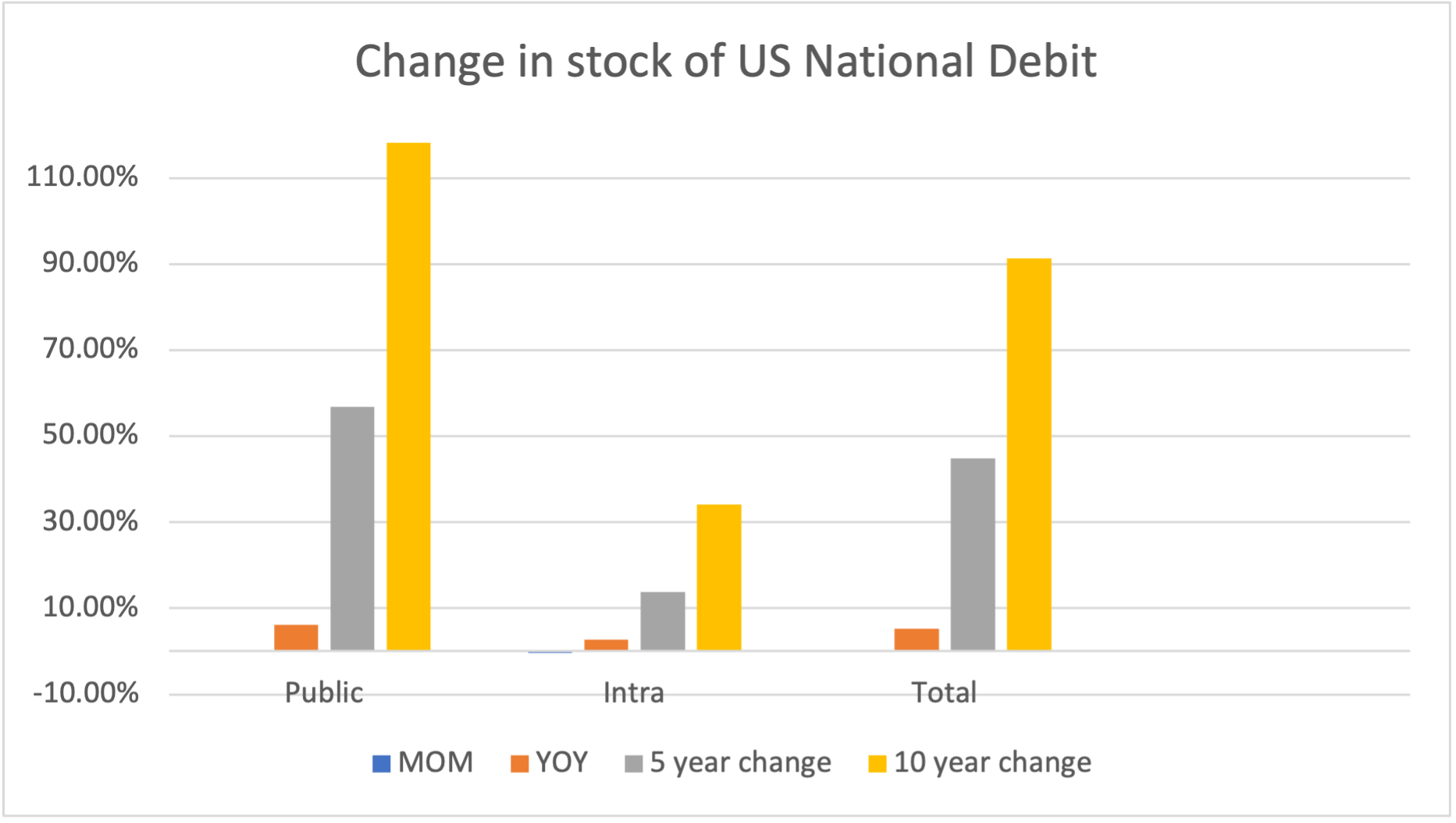

Negative US Liquidity

This is not the first time that we’ve seen US Government funding turn negative. However, it is the first time since the liquidity crises of 2019 that we could face a negative month against a policy backdrop that is likely to see a reduction in support for capital markets going forwards - this might not just be a one-off, it could be a taste of things to come. This is alarming because, whatever we think of these policies (and they are largely misunderstood), continually increasing positive flows are needed to maintain supportive conditions for asset prices and clearly what we’re seeing now isn’t supportive:

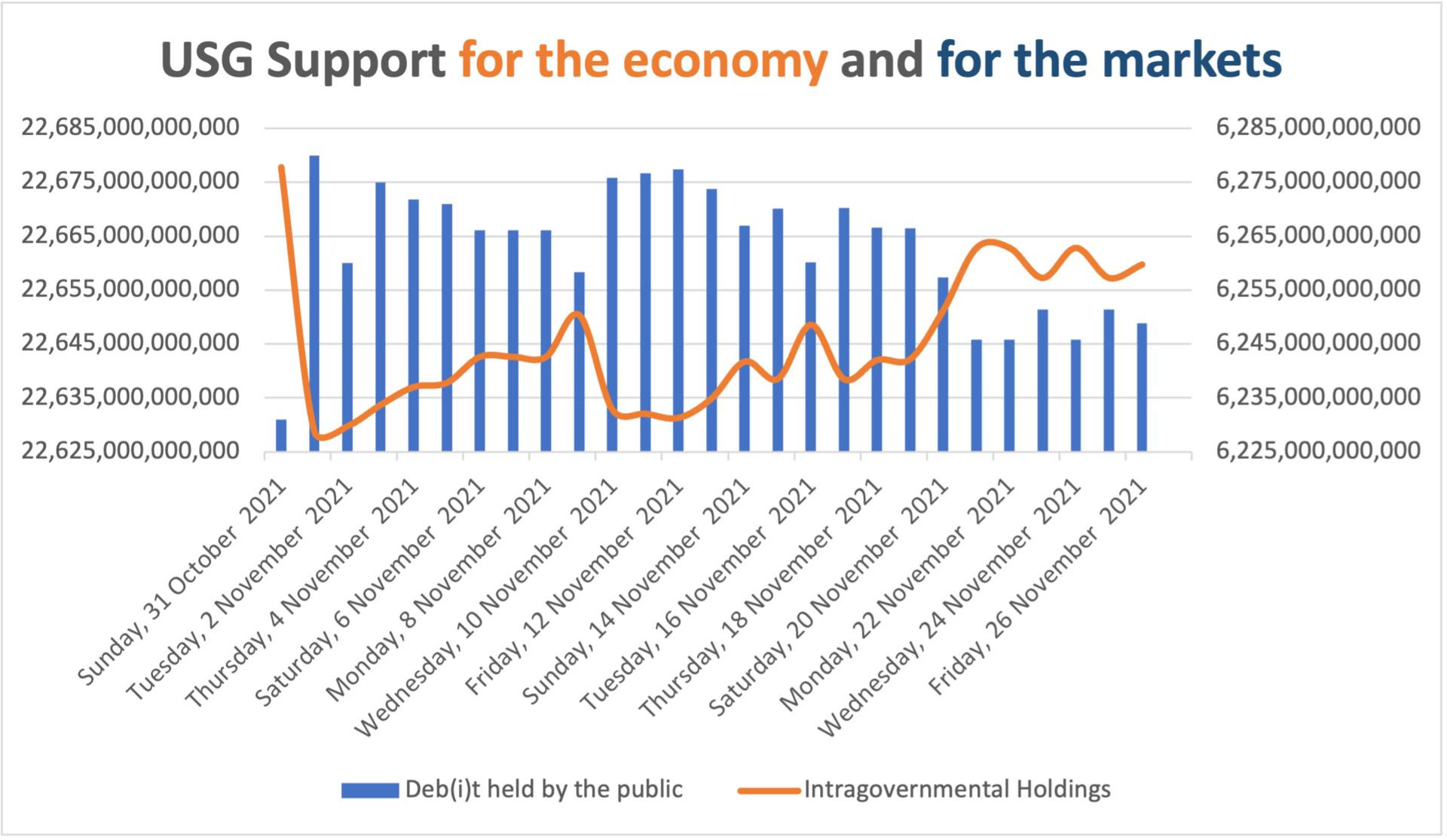

Refinancing Day-To-Day Spending

One way to look at the chart below is that at the beginning of the month, US Govt. reduced its internal balances (it’s a huge but useful oversimplification but this is reflected in the orange line, which is government spending money on day to day operations, or basically keeping the lights of America switched on), by refinancing them publicly (the blue bars, which represent the action of paying the bills PLUS all kinds of other activities such as providing the Fed with the thick end of $9 trillion over the last 13 years or so, which has driven US asset prices higher).

Earnings Growth A Poor Substitute for Liquidity

This doesn’t mean that markets will crash tomorrow but it does mean that until or unless policy changes once again, we should for instance see factors that drove asset prices higher (such as the expansion of price earnings ratio of stocks), continue to go into reverse and if that ratio is falling, then earnings expectations would need to expand at a faster rate. Otherwise, the basic arithmetic dictates that stock prices will fall.

Disclaimer: The above information has not been independently verified. This investment brief is given for information only and does not represent an investment proposal, recommendation or advice to invest in the shares or business of the subject company. Additional information shall be made available to interested parties subject to the execution of the requisite confidentiality undertakings. The financial information, actual and/or forecast, provide herein is based on management representation.

Latest Chamber News

- Industry Focus

- News and Opinions

- Industry Focus