Thinking of doing business in Thailand? Are you aware of The Office of The Board of Investment (BOI),

A government agency established to promote investment into Thailand and “from Thailand to overseas”?

Why BOI?

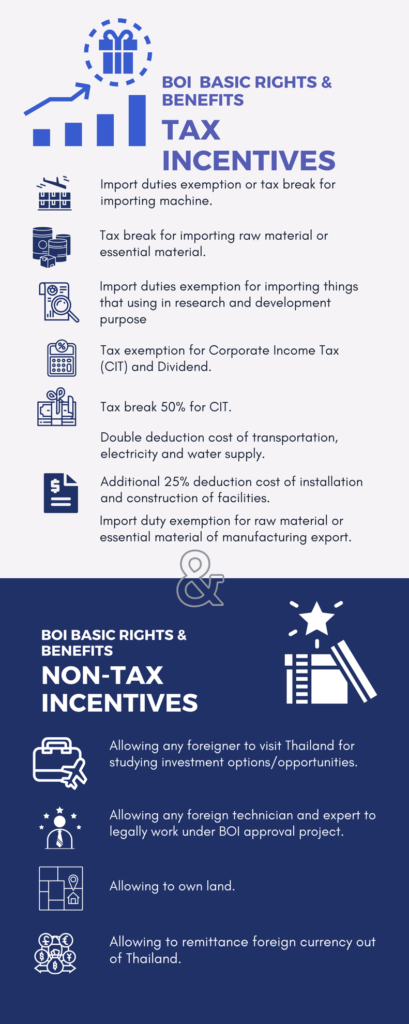

The BOI promotes various incentives, both TAX and NON-TAX based, to attract investment into Thailand. While certain criteria have to be fulfilled to qualify for such incentives, MBMG Group has helped dozens of businesses achieve these criteria and be able to benefit from the incentives throughout the last 25 years.

BOI promotion can apply to any eligible project or business activity (not just a standard company or corporate entity) within the following business sectors:

The incentives target different business center of all sizes and scale, with varying access to investment operating in a range of locations. However, The following pages provide an overview of main tax and non-tax incentives typically available under BOI promotion.

BOI Incentives According to Business Activities and Other Criteria

The BOI classifies 2 main categories of incentive for business wishing to invest in Thailand:

| Activity based incentives | Merit based incentives |

| •Group A •Group B | •Enhanced competitiveness •Promoted Areas •Specific Factors |

For More Details, https://mbmg-group.com/article/offering-sound-guidance-for-boi-thailand-outlook-june-2021

Although MBMG Group has undertaken BOI consulting on behalf of Multi-National Corporations (MNCs), most of our work with the BOI has focused on incentives for SMEs, intended to develop their capabilities, achieve sustainable growth, and gain access to funding in order to compete in international markets.

Promotion Investment for SMEs

| Qualifications | Specific Rights & Benefits |

| – Business Activities in Group A and B1. – Thai shareholders not less than 51%. – Minimum capital not less than THB 500,000 (excluding cost of land and working capital). – D/E ratio must not exceed 4 to 1. – Allowing to import used machinery with the value not over THB 10,000,000. – Investment in new machinery not less than 50% of value of all machinery that using in the project. – Total revenue of BOI and Non-BOI must not over THB 500,000,000 in the first three years from the date of first invoice of BOI. | – Import duties exemption or tax break for importing machine. – CIT Exemption for Group A at the rate of 200% of investment (excluding cost of land and working capital) |

| Merit-Based Incentive for SMEs Merit-based incentives to enhance competitiveness will grant projects an additional Corporate Income Tax exemption of up to 300% of the investment for a period up to three years. This includes research and development, technology, and innovation (in-house, jointly with organizations overseas, or outsourced to Thailand); technology training; and the development of proprietary technology or packaging products and designs. Merit-based incentives for decentralization are open to projects located in one of the 20 provinces with the lowest per capital income. Eligible projects may receive three additional years of corporate income tax exemption, provided that the total duration of the exemption does not exceed eight years. Projects in categories A1 and A2, which already receive corporate income tax exemptions for eight years, will instead receive a 50% reduction of corporate income tax on the promoted project after the end of the exemption period. Projects located in industrial estates or promoted industrial zones may avail themselves of merit-based incentives for industrial area development. Eligible projects will receive an additional year of corporate income tax exemption, provided that the total period of exemption does not exceed eight years. Finally, projects located in special economic zones (SEZs) may enjoy an additional corporate income tax exemption equal to 200% of the investment (excluding the cost of land and working capital). |

At MBMG GROUP, our team can support your applications to apply for business under the BOI Thailand promotion in every sector.

We can provide you with all the details related to the benefits of the BOI Thailand promotion and any and all tax incentives or non-tax incentives it has to offer, So please do not hesitate to CONTACT US or visit https://www.mbmg-group.com/