The serviced apartment market in Bangkok relies on both short- and long-stay guests. CBRE, a leading international property consultant, reports that since COVID-19-related travel restrictions were implemented, short-stay demand dwindled rapidly as global tourism came to a halt. Under the circumstances, serviced apartments are more likely to focus on long-stay expatriates to adapt to new and evolving market conditions. This is not the first time the serviced apartment sector has had to adapt to changing market needs.

Mr. Theerathorn Prapunpong, Head of Advisory & Transaction Services – Residential Leasing, CBRE Thailand, states, “Thailand’s tourism industry’s exponential growth, from 10 million in 2003 to almost 40 million tourists in 2019, caused serviced apartment operators to gradually focus more on the daily rate market to maximize revenue. Long-stay guests provide consistent occupancy at a lower average rate per night, whereas short-stay guests provide variable occupancy but at a higher average rate per night. This explains why most new serviced apartments now apply for a hotel license to access into both markets and diversify risk.”

The slowdown in the economy, which was further exacerbated by the outbreak of COVID-19, has negatively impacted long-stay demand in addition to short-stay demand. Nevertheless, the nature of the long-stay rental market showed much more resilience to the effects of COVID-19 due to ongoing yearly contracts that are often covered by expatriates’ companies.

“The combination of long- and short-stay guests is likely to continue as a trend in the future, especially with COVID-19 highlighting the needs for adaptation by potentially tapping into more diversified markets. However, not all serviced apartments will have the necessary flexibility to tap into both markets,” Mr. Theerathorn added.

Older serviced apartments often have structural limitations that legally prevent a hotel license from being granted. Even after a hotel license is granted, there is no guarantee that all serviced apartments will benefit from having both short- and long-stay guests. Focusing on short-stay guests puts serviced apartments in competition with hotels which might not necessarily lead to positive results. In addition, there are long-stay guests who do not appreciate the increased traffic as well as impact of short-stay travelers on their privacy.

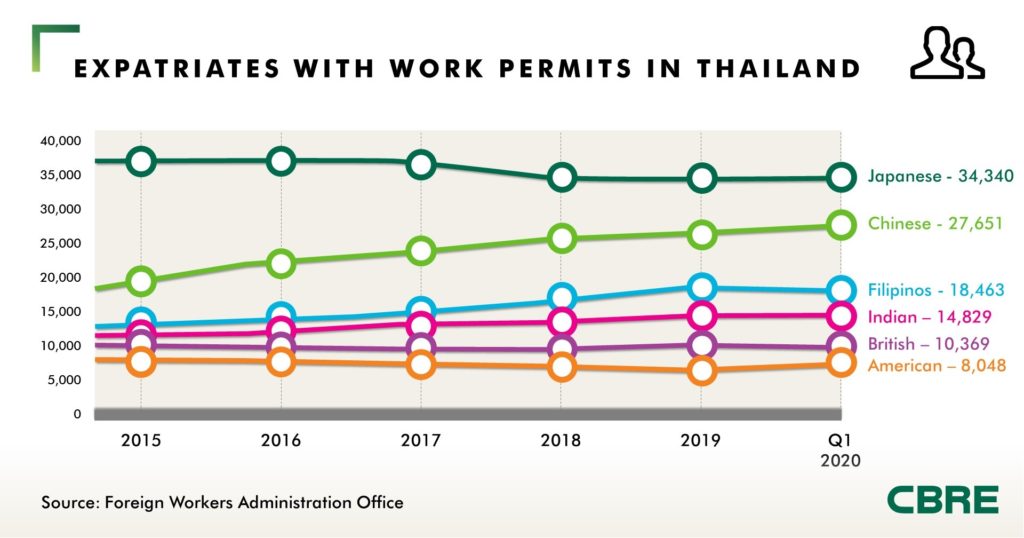

Many serviced apartments that were specially designed for Japanese expatriates are also less flexible to changes. These serviced apartments only allow Japanese long-stay guests and have unique services and amenities to please their clientele, such as having Japanese toilets and room interior. Because of this, the unique standards of these serviced apartments geared towards Japanese tenants might be incompatible with the needs of the average short-stay traveler.

Going forward, the future of the serviced apartment operating model is leaning towards the mix and match model between the short- and long-stay guests. Unfortunately, not all serviced apartments will be able to join this newer generation of serviced apartments, which are better suited to maximizing yield and surviving through future crisis due to risk diversification.