What is the LTR visa?

This visa will “provide a range of tax and non-tax benefits to enhance the country’s attractiveness as a regional hub for living and doing business for ‘high-potential’ foreigners,’ the Board of Investment Thailand said.

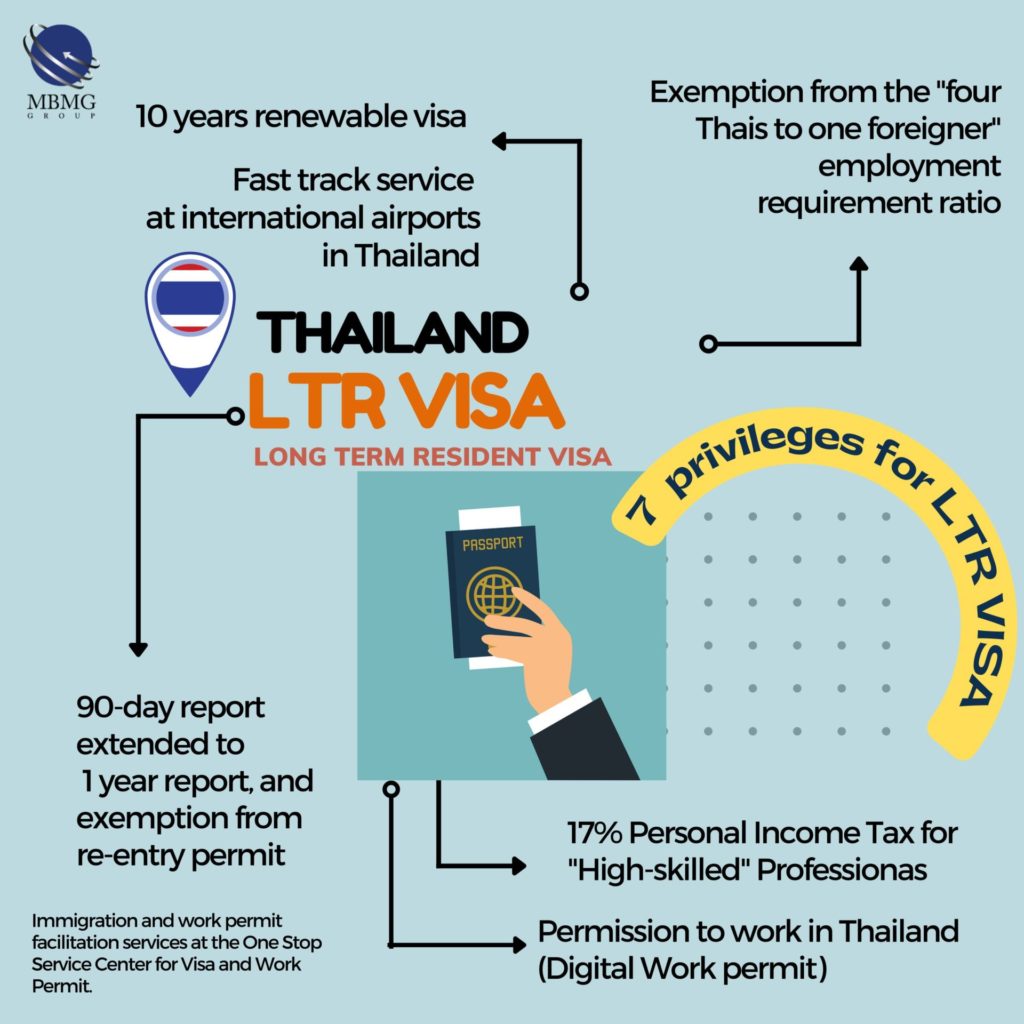

What are the benefits available to the holder of an LTR?

There will be various privileges for these visa holders, including:

- 10 years renewable visa

- Exemption from the “four Thais to one foreigner” employment requirement ratio

- Fast track service at international airports in Thailand; One of the drawbacks to forming a traditional company structure (Private Limited Company) in Thailand is the restrictions on hiring foreign staff. Typically, you are required to hire 4 Thai employees for each foreign member of staff. This quota is not applicable to LTR visa holders.

- Extension of the 90-day report to a one-year report, and exemption from re-entry permit requirements; The majority of visa holders in Thailand are required to submit a notification of their place of residence to the Thai Immigration Office every 90 days. This is not required for holders of the LTR who only need to do this report once per year.

- Permission to work in Thailand (Digital Work permit); This is a significant attraction for those who wish to come to Thailand as a Digital Nomad and work legally. This is currently not possible through the existing visas on offer.

- 17% personal income tax for high-skilled professionals, and

- Immigration and work permit facilitation services at the One Stop Service Center for Visa and Work Permit. Holders of the LTR visa will be able to take advantage of a special Personal Income Tax (PIT) rate of 17%. The current rate of PIT for normal employees is taxed at a progressive rate (from 5 to 35%). This is an attractive benefit, as it is likely that the tax rate for a ‘Highly Skilled’ professional (who the LTR is targeted at) will be taxed at one of the higher progressive rates. Therefore, this reduced PIT rate could result in a significant tax saving for the holder.

The visa will apply to four categories of foreigners:

Wealthy global citizens

Wealth status and investment

• Minimum of US$1mn in assets

• Minimum personal income of US$80,000/year in the past two years

• Investment of at least US$500,000 in Thai government bonds, foreign direct investment, or Thai property

Health insurance

Health insurance of at least US$50,000 coverage or social security benefits insuring treatment in Thailand, or at least US$100,000 deposit.

Wealthy pensioners

Wealth status and investment

• Personal income of at least US$80,000/year at the time of application

• In case of personal income below US$80,000/year but no less than US$40,000/year. applicants must invest at least US$250,000 in Thai government bonds, foreign direct investment or Thai property

Health insurance

• Health insurance of at least US$50,000 coverage or social security benefits insuring treatment in Thailand, or at least US$100,000 deposit.

Work-from-Thailand Professional

Personal income

Personal income of a minimum of US$80,000/year in the past two years

In case of personal income below US$80,000/year, but no less than US$40, 000/year in the past two years, applicants must have a Master’s degree or above, own intellectual property, or receive Series

A funding.

Current employer

A public company on a stock exchange or; a private company in operation for at least three years with combined revenue of at least US$150mn in the last three years.

Experience

At least five years of work experience in the relevant fields of the current employment over the past 10 years.

Health insurance

Health insurance of at least US$50,000 coverage or social security benefits insuring treatment in Thailand, or at least US$100,000 deposit.

Highly-skilled professional

Personal income:

Personal income of a minimum of US$80,000/year in the past two years

In case of personal income below US$80,000/year, but no less than USD$40,000/year in the past two years or before retirement, applicants must have a Master’s degree or above in science and technology, or special expertise relevant to the job assignment in Thailand.

No minimum personal income for professionals working for Thai government agencies.

Current employer:

A business in any targeted industries

A higher education institution, research institution, specialised training institution, or Thai government agency.

Experience:

At least five years of work experience in the targeted industries except for applicants with a PhD or above in the relevant fields of the targeted industries, or applicants working for Thai government agencies.

Health insurance:

Health insurance of at least US$50,000 coverage or social security benefits insuring treatment in Thailand, or at least US$100,000 deposit.

Dependants, i.e. spouses and children under 20 years old of LTR visa holders (maximum of four dependants in total per one LTR visa holder) will also qualify for the same visas.

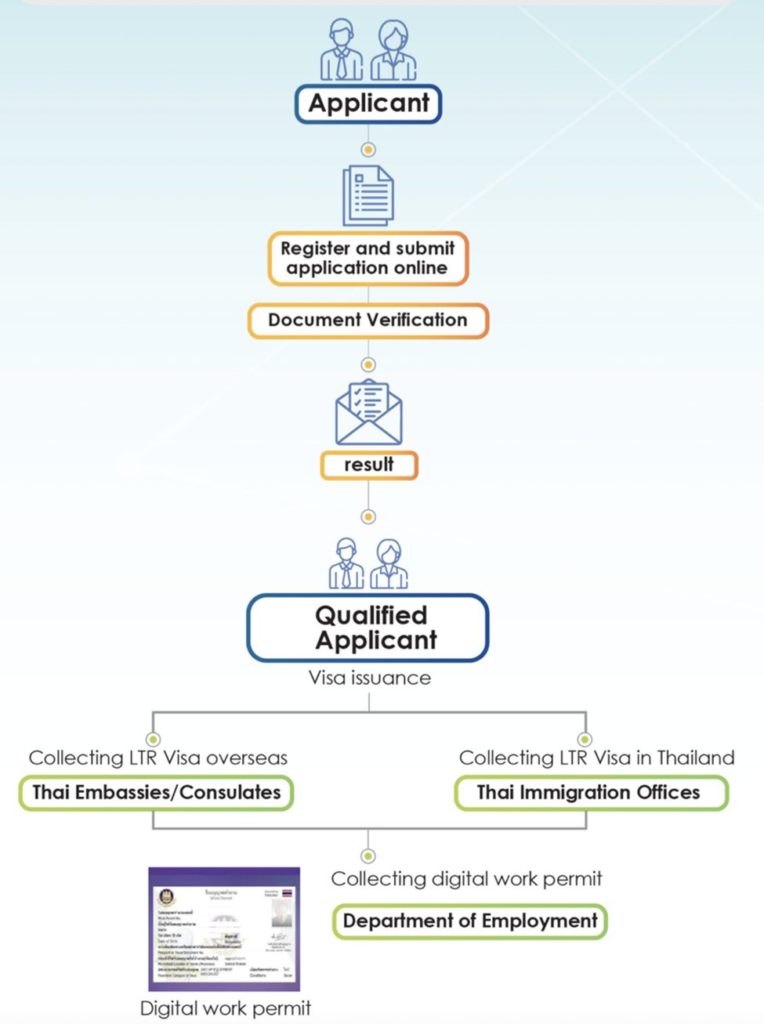

Ref: Publication of Thailand Board of Investment (in English), “ LTR: Long-Term Resident Visa.” https://www.boi.go.th/upload/content/LTR.pdf How to get LTR visa in Thailand

MBMG Team offers a wide range of practical solutions.

For further information please contact

[email protected]

or

[email protected]